France’s fraught political landscape and a gridlocked budget continue to spook economists and investors.

France’s central bank expects the national economy to grow by 0.9% in 2025, it announced on Monday evening.

The new figure is a downgrade from September’s forecast of 1.2% and comes after 1.1% growth in 2024.

The bank also reduced its growth prediction for 2026 by 0.2 percentage points, to 1.3%.

Growth of 1.3% is equally expected in 2027 – with wages forecast to outpace inflation.

Credit downgrade

The announcement arrives amid a period of political turmoil in France, which last week prompted ratings agency Moody’s to downgrade the country’s credit score to Aa3.

Moody’s highlighted concerns over a growing national deficit, which it expects to reach 6.3% in 2025.

France has already faced disciplinary measures at an EU level for overspending in 2024, overshooting the bloc’s deficit limit of 3%.

The deficit will be at 6.1% of GDP this year, according to government estimates.

More optimistic than Moody’s, the central bank expects the public deficit to come in at between 5% and 5.5% of GDP next year.

These predictions were nonetheless finalised before the government collapsed earlier this month.

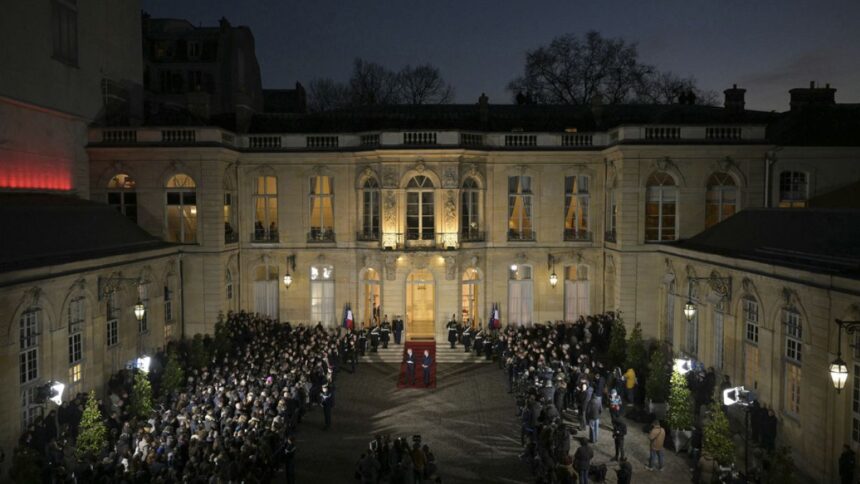

Following a budget-related dispute, former Prime Minister Michel Barnier was ousted in early December, replaced by François Bayrou.

France is now working on emergency legislation to prevent a government shutdown, in the absence of a 2025 budget bill.

The central bank warns that emergency legislation would significantly increase next year’s deficit – adding that it could increase income taxes by about €4bn.

Uniting a split parliament

Deep divisions continue to plague the National Assembly, particularly after a controversial snap election earlier this year.

No party gained enough seats for a majority in the French parliament, meaning that Bayrou must now unite these fractured groups.

Bank of France Governor Francois Villeroy de Galhau has notably urged politicians to put aside their differences “for the credibility of France”.

The bank expects harmonised inflation at 2.4% this year, 1.6% in 2025, and 1.9% in 2027. These figures are nonetheless influenced by tax measures planned by the Barnier government, which may or may not be applied under Bayrou.