As wildfires and hail damage continue to increase home insurance rates in Colorado, around 90% of prospective homebuyers in the West consider at least one climate risk factor when purchasing a home.

In late September, Zillow incorporated climate risk data from First Street Foundation, a nonprofit that assesses climate risk, into for-sale property listings across the U.S.

This new feature gives home shoppers insights into five key risks: flood, wildfire, wind, heat, and air quality. The listings now include risk scores, interactive maps, and information about insurance requirements.

“Climate risks are now a critical factor in home-buying decisions,” said Skylar Olsen, chief economist at Zillow. “Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions. As concerns about flooding, extreme temperatures and wildfires grow — and what that might mean for future insurance costs — this tool also helps agents inform their clients in discussing climate risk, insurance and long-term affordability.”

Increasing risk

An August Zillow analysis found that more new home listings nationally show significant climate risk compared to those listed five years ago. This trend applies to all five climate risk categories.

For example, about 17% of new listings in August showed significant wildfire risk.

Rising premiums

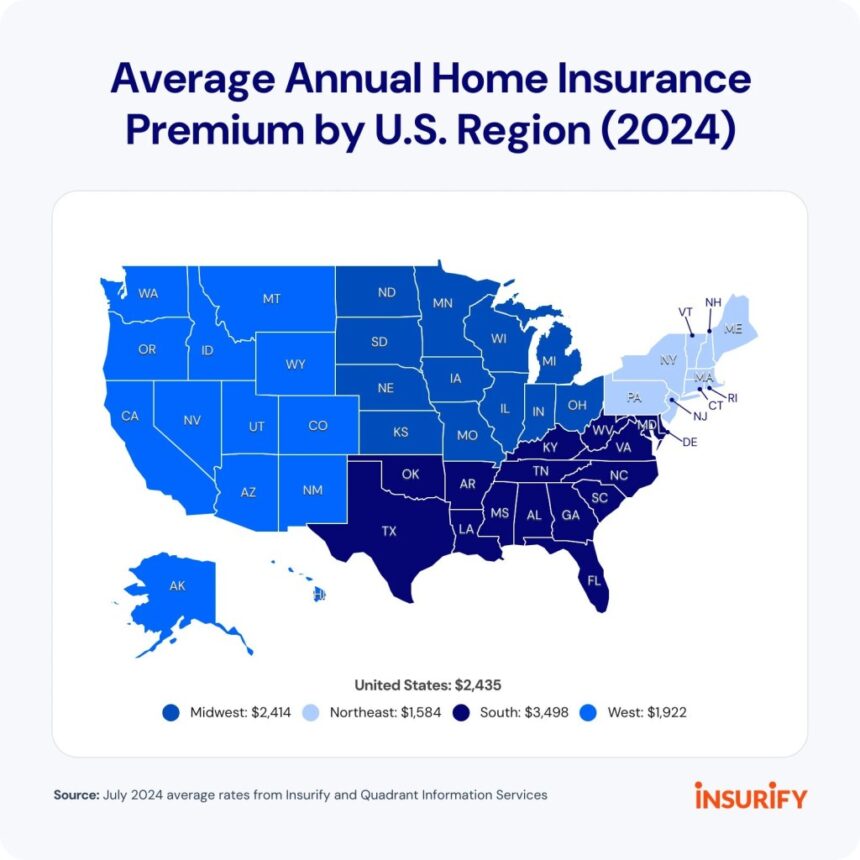

Climate-related weather damage is driving up insurance rates across the U.S. According to an analysis from Insurify, a digital insurance agent that provides real-time quotes from more than 100 insurers, homeowners in 15 states, including Colorado, can expect continued weather-related rate hikes and declining competition from insurance companies.

According to Insurify’s research, Colorado has the second-highest property damage losses to hail, at $151 million annually. The state also has over 321,000 homes at risk of wildfire, with reconstruction estimated at $141 billion.

Frequent and severe hailstorms and increasing wildfire risks drive up home insurance premiums in Colorado. At $4,186, the state’s average premium is among the highest nationally.

In 2022, 76% of insurers scaled back in high-risk areas, resulting in higher premiums and fewer choices.

Chase Gardner, Insurify data insights manager, said insurance companies struggle because natural disaster claims exceed premium increases. That’s led some states, like Florida, to create state-run insurance programs for high-risk homeowners.

State legislators passed the Colorado Fair Access to Insurance Requirements (FAIR) Plan in 2023. This property insurance program is expected to launch in 2025 and cover individuals and businesses in areas prone to natural disasters or other risks that cannot get traditional insurance.

To qualify for the FAIR Plan, homeowners must receive multiple denial letters from insurers and take steps to reduce wildfire risk. FAIR Plan policies typically offer less coverage at a higher cost and are designed as a last resort until people find alternative coverage.

Getting the best deal

Gardner said homeowners can take steps to lower their insurance costs. He recommends shopping and comparing policies to get the best rate.

“Different companies calculate the risk differently, so you might find one that will give you a lower rate,” Gardner said. “It’s always good to check around.”

He also suggests buying a separate disaster policy to cover severe hail or weather events. The additional disaster policy allows you to raise your home insurance deductible.

“You can combine these policies, which can save you hundreds on your policy,” he said.

Gardner also recommends switching to stormproof windows and a metal roof, which is significantly more hail-resistant than a standard shingle roof.

The news and editorial staffs of The Denver Post had no role in this post’s preparation.